net operating working capital definition

Additionally the net working capital ratio can give you an idea of how a company uses its funds to reinvest in its continuous growth. As a working capital example heres the balance sheet of Noodles Company a fast-casual restaurant chain.

Working Capital Ratio Analysis Example Of Working Capital Ratio

Along with fixed assets such as plant and equipment working capital is considered a part of operating capital.

. Working capital or net current assets An accounting term denoting a firms short-term CURRENT ASSETS which are turned over fairly quickly in the course of business. The formula chosen should be consistently applied do not switch between formulas when conducting trend analysis or peer comparisons as the calculation differs depending on which formula is used. Net working capital provides valuable insight into a companys financial health and profitability.

10000 x 1 - 03. Gross working capital is equal to current assets. Working capital WC is a financial metric which represents operating liquidity available to a business organization or other entity including governmental entities.

Net income can be distributed among holders of common stock as a dividend or held by the firm as an addition to retained earningsAs profit and earnings are used synonymously for income also depending on UK and US usage net earnings and net profit are commonly found as synonyms for net income. NOPAT Example. A companys net working capital is necessary to cover its operational costs and add to its future development.

Often the term income is substituted for net income yet this is not. 90 shows the major components of the working capital cycle. Current ratio and the quick ratio.

For example if EBIT is 10000 and the tax rate is 30 the net operating profit after tax is 07 which equals 7000 calculation. Working capital management helps maintain the smooth operation of the net operating cycle also known as the cash conversion cycle CCCthe minimum amount of time required to convert net. Working Capital is the capital available for daily operations and is calculated as current assets minus current liabilities.

They include raw materials work in progress and finished goods STOCKS DEBTORS and cash less short-term CURRENT LIABILITIESFig. As of October 3 2017 the company had 218 million in current assets and 384 million in current liabilities for a negative working capital balance of -166 million.

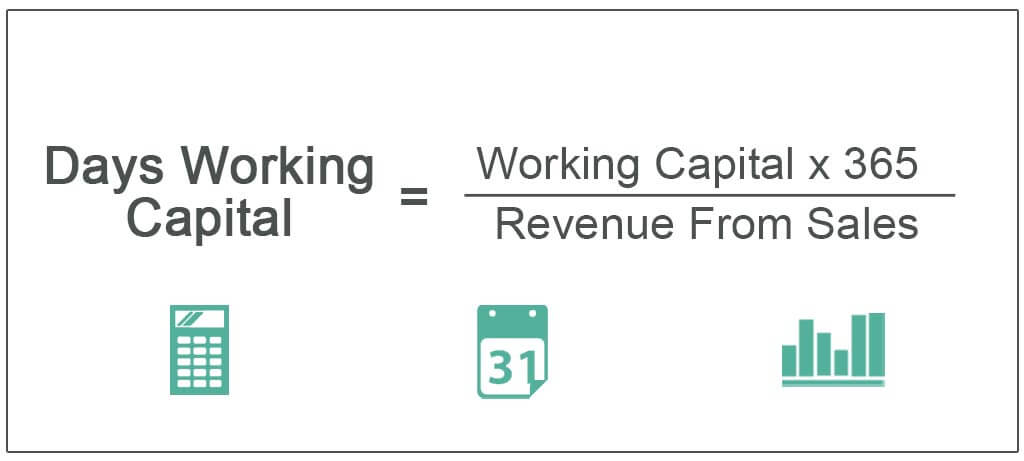

Days Working Capital Definition Formula How To Calculate

Days Working Capital Formula Calculate Example Investor S Analysis

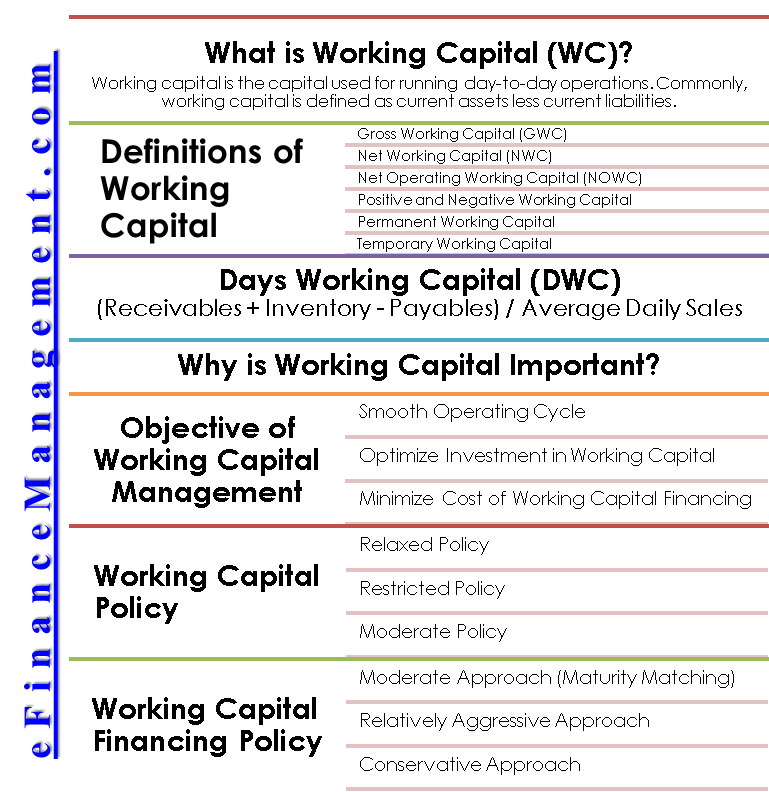

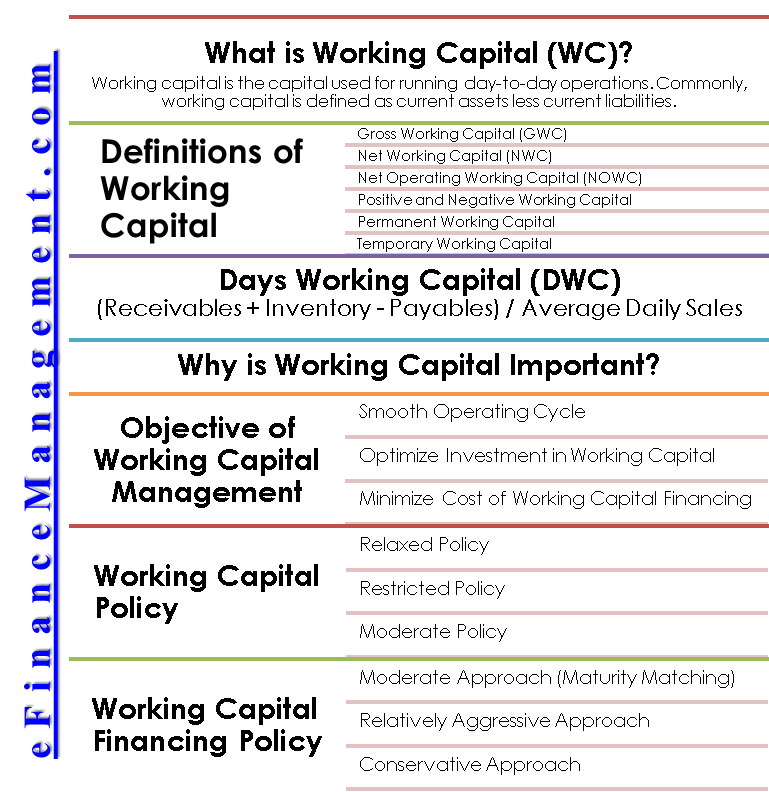

Working Capital Define Importance Objective Policy Manage Finance

Changes In Net Working Capital All You Need To Know

Working Capital Example Formula

Working Capital Cycle Understanding The Working Capital Cycle

/WORKINGCAPITALFINALJPEG-4ca1faa51a5b47098914e9e58d739958.jpg)